Risk on - can it continue?

Risk on - can it continue?

As we have been calling for a rally for sometime, the next question is can it continue? The data is not clear, but little upside is left. Let’s examine EM Risk, Long/Short, Financials, Yield and Vol

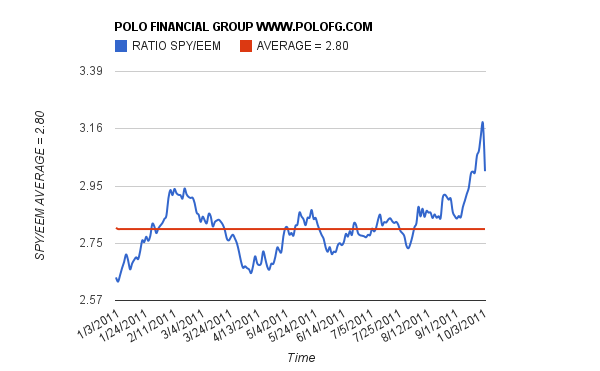

1. EM Risk attitude can still get more attractive, expect more inflows

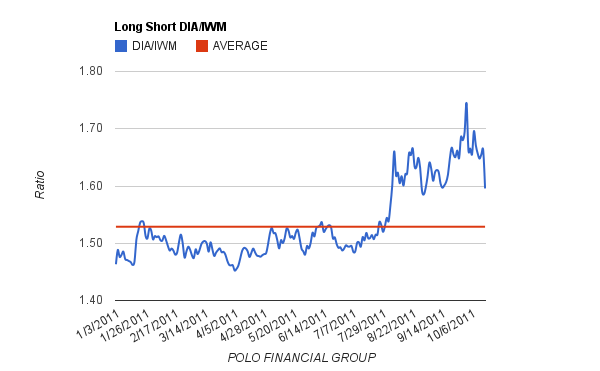

2. Long Short world no longer has a clear edge, it still sits with 10% move in any direction - same story, high correlation, not working.

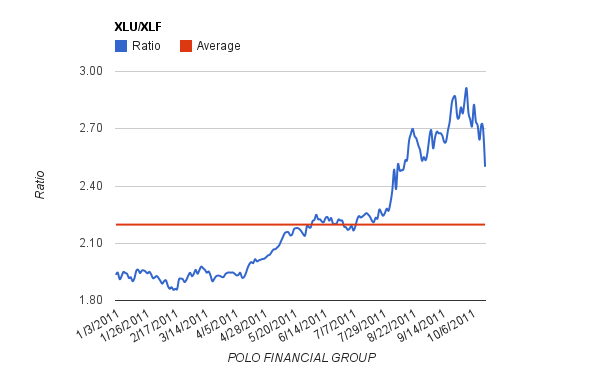

3. The financials could still rally, however now that earnings are out, it is clear they should be down 50% - Financial stock ROE’s have been cut in half. Who is holding worthless CDS is also a looming question?

4. The hunt for lower quality yield continues and still has edge - this trade supports our lower long term vol thesis

Crap and Web Protect Baskets - Portfolio Recap and patiently waiting for the next vol trade

Crap and Web Protect Baskets - Portfolio Recap and patiently waiting for the next vol trade

In spite of our thesis being fully intact - call for a market rally and vol collapse, our fundamental indicator of supply and demand is still not a giving a green light signal. The market players are not piled up in a long or short vol trade at the moment, making finding edge a bit harder.

However, we continue to focus on two equal weighted baskets and continue to add on any dips.

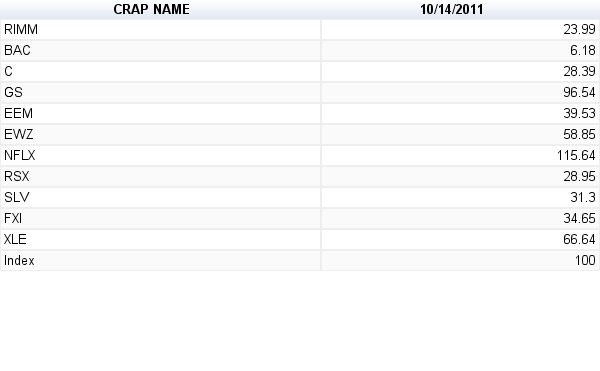

1. Crap Basket - Thesis simply revolves around out of favor stocks. Time Frame is now to year-end

2. Web Security - Thesis focus is a hedge for short vol and paradigm shift for corporations creating a real “need” Time Frame is 12 months.

Closed XLF trade - Trade Performance +50%

Closed XLF trade - Trade Performance +50%

PFG closed out XLF Oct 13 calls today. The short term pain thesis worked out well as financials rallied from massive index dislocations and funds underweight financials.

Web Security - Next Bubble?

Web Security - Next Bubble?

In an earlier post, we reviewed the many revolutionary steps that are taking place in Wall Street and the amount of disruptive technology that is making many functions and processes currently done by humans, obsolete. One way PFG believes to play this new world is to own a basket of web security stocks. Not only do we believe this is great hedge for our long term-short vol thesis, the stocks are fairly priced in the market.

At this point, we cannot find an ETF, but are very sure one will probably get listed. The current events of protesters, hackers and the recent outage at blackberry are pointing more and more for a “real need” for stronger online security. No exec wants to make it easy to access his personal info, no bank wants client information reveled and a caring father wants his daughters pictures of the web asap. The uprising of social media tools, supporting the narcissistic facebook epicenter of global information is just staggering. Many companies exist currently to help with managing your global identity, however they cannot do much once information security has been comprised. As the world moves on-line, forced faster then ever before to reduce costs and adapt these new disruptive technologies, PFG believes on-line security will be at the top the list with compliance at most banks. In addition, it will also be the front gate for data mining, real time business intelligence and accessing proprietary correlation data.

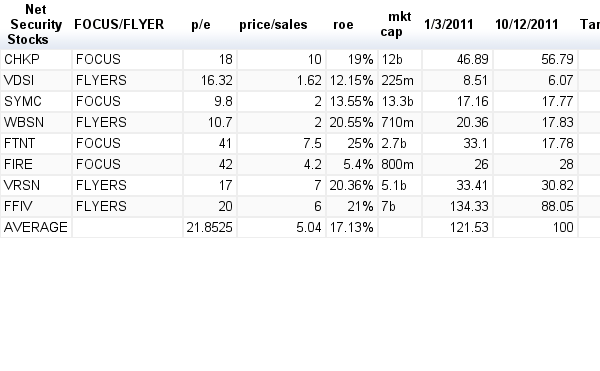

Basket

We are building a position on this equal weighted basket on dips in the market, with a 12m + time horizon, unless we reach our 25% upside target sooner. We started building our position on Oct 12 2011 and set the index to 100. The basket was down 21.5% for the year before we decided on this thesis.

Massive Volatility Collapse - Expect More

Massive Volatility Collapse - Expect More

Earlier this week, we identified some ST pain trades in the market. In addition, we positioned for a market rally by looking at the following

1) Cash Levels

2) Inverted Vol Curve

3) Outflows making new highs

A risk on moment brought on a incredible market rally with a subsequent volatility collapse.

In just two weeks, Global Volatility Levels have collapsed,