The current state of the market is one of confusion, distrust and fear. The only guys that seem to be getting it correct are the technical nimble traders. Everything else just doesn’t seem to be working. The market has consistently or near perfectly traded well along short term trading signals that are available to anyone for free with an e-trade account. Yet the folks with multi-factor correlation models of mass sophistication and large fee’s are nowhere close to performing well as the index.

Performance pain

Most traders discounted gold some time ago, others have called for bubbles and yet it has defied all logic and performed well. On the flip side, the financials stock that employees most of the financial guru’s have collapsed. (-25%)

2011 YTD, as of September 30, 2011 Ranging from +15 to -25%

BEST

+15% Barclays 7-10yr

Treasury ETF

Gold

UTILITIES

CONSUMER STAPLES

HEALTH CARE

Dow Jones/Credit Suisse

Global Macro

0%$/Euro

TELECOM SERVICES

DJ/CS Blue Chip

Hedge Fund Index

Dow Jones/Credit Suisse

Long Short Equity

CONSUMER DISCRETIONARY

INFORMATION TECHNOLOGY

Russell 1000 Growth

-10% S&P 500

Nasdaq

Dow Jones/Credit Suisse

Event Driven

Lipper Large-Cap Core

Mutual Fund Index

Russell 1000

ENERGY

Russell 1000 Value

Crude Oil

INDUSTRIALS

Russell 2000

MATERIALS

-25% FINANCIALS

WORST

Long Short Pain

A great example is the simple metric of using DIA/IWM for Long/Short Funds. The funds before the recently rally were totally off-side and it’s still not clear if we are entering a new range landscape or will revert to any sort of mean.

Tail Event Pain

2011 YTD, as of September 30, 2011 Ranging from +15 to -25%

BEST

+15% Barclays 7-10yr

Treasury ETF

Gold

UTILITIES

CONSUMER STAPLES

HEALTH CARE

Dow Jones/Credit Suisse

Global Macro

0%$/Euro

TELECOM SERVICES

DJ/CS Blue Chip

Hedge Fund Index

Dow Jones/Credit Suisse

Long Short Equity

CONSUMER DISCRETIONARY

INFORMATION TECHNOLOGY

Russell 1000 Growth

-10% S&P 500

Nasdaq

Dow Jones/Credit Suisse

Event Driven

Lipper Large-Cap Core

Mutual Fund Index

Russell 1000

ENERGY

Russell 1000 Value

Crude Oil

INDUSTRIALS

Russell 2000

MATERIALS

-25% FINANCIALS

WORST

Long Short Pain

A great example is the simple metric of using DIA/IWM for Long/Short Funds. The funds before the recently rally were totally off-side and it’s still not clear if we are entering a new range landscape or will revert to any sort of mean.

Tail Event Pain

For fund managers that reached for protection before and during the crisis, the protection trades became victim to large drops in volatility and skew levels. What seemed to be safe bet and paying anywhere between 5-10% for protection is now heavily discounted and the market has yet to go anywhere. What to do with all these puts now?

Spread Pain

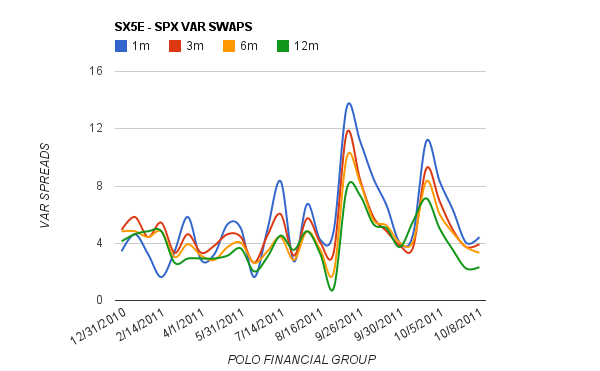

For volatility traders, it seemed as a safe bet to be long Euro Stoxx vol and short SPX vol to play the Euro default for vol outperformance. That trade as we can see from the below graph shows that spreads have collapsed. Is it the right time to buy this cheaper tail?

Term Structure Pain

Spread Pain

For volatility traders, it seemed as a safe bet to be long Euro Stoxx vol and short SPX vol to play the Euro default for vol outperformance. That trade as we can see from the below graph shows that spreads have collapsed. Is it the right time to buy this cheaper tail?

Term Structure Pain

Variance Swap term structure has also massively inverted from this recent rally. This type of pain on the street is possibly the worst, because it requires traders to go almost line by line and investigate all positions on the books and understand all the moving parts. This usually results in traders crossing many spreads to get the exact trades off the books. This will take time to filter through the markets

What did nobody do?

What is the max pain path in the market short term?

Moving from the current market to even a greater high will require a large upside participation from global financial stocks (~ .75 Book) PFG feels the best way to capture the max pain path is to buy short term calls on XLF.

What did nobody do?

- Buy Calls

- Expect a rally

- Keep low cash levels

- Not buy risk management tools

- Stay market weight financials

What is the max pain path in the market short term?

- Up

- lower volatility levels

- Raise in longer dated vols

- Europe/SPX spreads blowing out

- Interest rates raising

- Gold/Defensive stocks sinking

- Financials/Materials raising

- IWM sinking and Blue chips outperforming

Moving from the current market to even a greater high will require a large upside participation from global financial stocks (~ .75 Book) PFG feels the best way to capture the max pain path is to buy short term calls on XLF.

No comments:

Post a Comment