In any vol compression, market stabilizing market, we can expect first yields to blow out with vol expansion, but also a compression just as quick. Another way to take advantage of high vol is to get short spreads in yields.

TRADE IDEA:

SHORT $TLT

LONG $HYG

SHORT $ES_F (.25 UNITS)

Graph Spot close Aug 25th = 1.2635

This blog is dedicated to finding edge in the volatility markets around the world www.polofg.com

Friday, August 26, 2011

Thursday, August 25, 2011

Is it the right time to short vol and short the market?

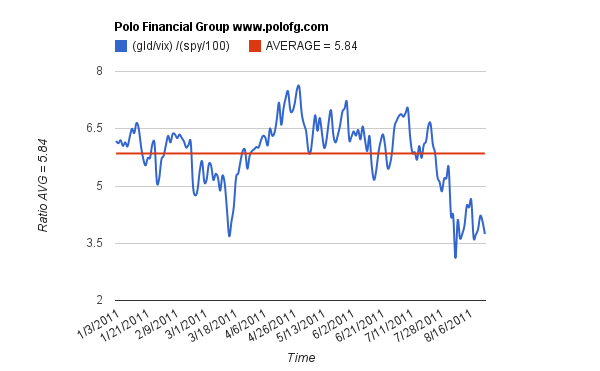

Since gold has become a very talked about fear index, almost now more then the vix, does it make sense to use it as a benchmark of fear vs the index?

In looking for edge in this current market, the vol market seems to imply that having a short vol, short market position has the best edge. The amount of excess vol points in the vix seems to compensate well against any face ripping rally at the current levels.

Where does this leave gold? I believe the path for both gold and market is lower, however a grind, which will cause the vix to collapse.

TRADE IDEA:

SHORT $ES_F 1163 SEPT

SHORT SPY OCT 100/125 STRANGLE FOR $3.60 CREDIT

LONG $GC_F 1774 SEPT

Graph spot Aug 25th close = 3.728

In looking for edge in this current market, the vol market seems to imply that having a short vol, short market position has the best edge. The amount of excess vol points in the vix seems to compensate well against any face ripping rally at the current levels.

Where does this leave gold? I believe the path for both gold and market is lower, however a grind, which will cause the vix to collapse.

TRADE IDEA:

SHORT $ES_F 1163 SEPT

SHORT SPY OCT 100/125 STRANGLE FOR $3.60 CREDIT

LONG $GC_F 1774 SEPT

Graph spot Aug 25th close = 3.728

Subscribe to:

Posts (Atom)