Canadian Housing Bubble: Two Stories, Commercial RE is very over-valued (40%) and Residential RE is over-valued by 10%

In fact, the Real Estate market in Canada has trumped Financials and even the countries staple - Energy

Try to find a bull on Canadian Real Estate, you won’t. The housing market seems to have everyone upset about new highs being made everyday and bidding wars. However, it’s not as bad as it seems on the residential side, but the CRE side is going to plunge. REITs are very overvalued and it could easily move lower by 25% +.

Just have a look at the “For Lease” signs on commercial buildings in Toronto, Vancouver and Montreal. Meanwhile, housing rental vacancy is sitting at very low levels. These friendly sounding stocks are no more then highly leveraged financial instruments that give the stock holder the worst slice of the debt. It only takes a small move in a lease loss or asset prices to fully wipe out the REIT holder. Hence the higher yield. The game is to pay real estate valuation firms to make "fair value" NAV prices and hence the banks don't re-value the loan and shareholders dont ask any questions. A forced slow motion margin call can turn fast when investors hit eject.

Good News First

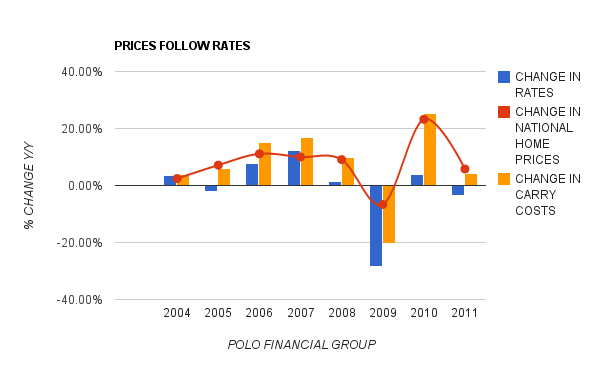

Residential Real Estate has not had any major increase in debt-servicing in over 4 years. Its cost the same to run a house today as it did in 2007/2008 peak. Lower rates have made it possible. Looking at any measure that includes income is simply wrong (we don't know about off-shore mortgage, the cash buyer, bank of mom and dad, etc)

1. The cost of running a home has moved up marginally since 2007, however still overvalued and a 10% drop on a much higher notional means a higher dollar loss, which is meaningful on a leveraged personal balance sheet. But with no margin call on homes, it won't be US style. It will have to arrive from folks losing jobs, rate shock, etc.

.

2. Rates are about 50bps lower since 2003

3. Looks shocking, but debt-servicing is the same as 2008. Lower rates have allowed us to pay 20% more for homes

4. It takes about 1yr in lag to catch equilibrium levels from changes in interest rates

5. The CRE side is a different story, the graphs speak for themselves. Cap Rates/Distributions to holders are almost at decade low levels, yet the prices have managed to stay at peak levels. Interest rates have played the major role, however we are at the end-game. { 1. Low caps, 2. High Prices 3. Low Rates. } Not much flex here. Do people really believe that they hold REITs with such high yields and have no risk? Willful blindness are the best exit and shorting opportunities

CANADIAN FINANCIAL VS SPX, US FINANCIALS

2yr chart of XRE vs Cad Consumer, Energy and Canadian Financials

5yr chart of XRE vs Cad Consumer, Energy and Canadian Financials

BMO’s 2.99% 5-Year Fixed Sets Bank Record

Later today, BMO is reportedly announcing the lowest advertised 5-year fixed rate ever for a Canadian bank.

It’s a 2-week promotion at 2.99%. Official announcement to follow.

Manhattan Prices are the same on sqft since 2002

Housing Investment vs GDP, 2.5 year lag before correction. Implied 2014

And when it does finally hit, it take a very very very long time to get the same you paid for it...

More Condos please

US HOUSING CRASH NOW ERASES 10 YEARS OF GAINS 2012 prices = 2002

So how much does Housing impact Canada?

"With an average price topping $348,000 in January, Canadian homes are now worth a total of $3 trillion, nearly twice the country’s GDP. Home prices have doubled since 2002 and risen 13 per cent since the global recession hit in 2008.

When home prices rise, so does consumer confidence. Canadians, believing that their bricks and mortar are a gold mine, have become ever more willing to open their wallets. In less than 10 years, consumer spending has gone from 58 per cent of Canada’s GDP to 65 per cent.

The housing boom has helped prop up Canada’s construction industry, which now represents 7.4 per cent of the labour force, higher than it was in the U.S. at the height of its boom. Add in other housing-related industries, such as real estate agents, mortgage brokers and insurance companies, and the sector represents a staggering 27 per cent of the Canadian workforce. In the U.S., those same numbers peaked at 23.5 per cent.

More worrisome is where consumers have been getting their spending money. As wages stagnate and credit card use levels off, Canadian consumers have increasingly turned to their homes as a source of cash. As of last year, Canadians had pulled roughly $220 billion from their houses in revolving home equity lines of credit, a per capita amount three times larger than the U.S. at its peak.

Home equity lines of credit, known in the industry as HELOCs, have increased 170 per cent in the past decade, twice as fast as new mortgages. The federal government recognized just how risky HELOCs had become last April, when it announced it would no longer allow the Canada Mortgage and Housing Corporation to insure them.

But why should Global Bond Buyers care? Everything is CMHC stamped. The Banks actually want more mortgages to feed the demand....

"Since they were first introduced in Canada in 2007, such investments, known as covered bonds, have grown from a $2-billion industry to $50 billion, with much of the growth coming in just the last year. The rise in mortgage bonds has also worked to drive mortgage rates down by freeing up banks’ money to make more loans."

Purchasing Power running out of steam

"Mortgage rates are especially vulnerable. Shorter-term variable rates, which are linked to the Bank of Canada’s overnight rate, have become increasingly popular, now making up about 40 per cent of the market. Nearly half a million homeowners swapped their fixed-rate mortgage for variable rates last year. “If you’ve got a very big variable rate mortgage and those rates moved up two to three per cent, I think a lot of families are right at the line in terms of spending and suddenly they’re looking at a very big jump,” "

Good or bad, the banks want it off the books,

"Canada’s housing policy, including reining in the growth of mortgages insured by the CMHC. This month, the government-backed insurance corporation warned that it was close to maxing out its $600-billion budget for insurance, driven in large part by banks insuring portfolios of low-risk mortgages, which are repackaged as bonds and sold to investors, primarily in the U.S."

CMHC Data

"As at 30 September 2011, the CMHC had only $11.5 billion CAD of shareholder capital but a whopping $541 billion CAD of outstanding insured loans, which works out at only 2.1% equity against its overall exposure. In fact, the CMHC’s capitalisation is only slightly better than the US Government-sponsored Fannie Mae, which in 2007, at the peak of the US housing bubble, backed up US$2.7 trillion of mortgage-backed securities with US$40 billion of capital, or 1.5% equity against its overall exposure."

RENT TO OWN

LUXURY TORONTO CONDO PLACE ORGANIC AD in FT

"“The demand for large residences from 3,000 sq ft to 5,000 sq ft has been a real

surprise,” says Janice Fox, Four Seasons director of sales. “They all sold out within the

first year. We could easily sell another hundred more.”

Then the following a week, the sold out building suddenly has inventory and ads are placed

The Cube Indicator

Dubai marked the top with a cube

Toronto Cube

and its back, BMO 2.99%. The adverts can't keep up