Polo Financial Group: Book Review of The Option Trader’s Hedge Fund

Rating: 4 of 5

Once in awhile an option book is published that can be tossed into the pile with Natenberg, Taleb and Hull. This is one of them. The Option reading material until very recently has been very divided

1. Very Technical to Option trading for dummies

2. Option Trading based on math, not market reality

The Option Trader’s Hedge Fund is the missing book that traders need. The book links the math, trading ideas and option terminology from the perspective of the Wall Street trader.

In just a few years, technology that was once only available to large wall street firms is now available to almost anyone. However, the technology will never teach you a disciplined trading framework. This book will.

The authors have taken the time to explain a step-by-step method to trading - simple things as a trading diary to more complicated risk management. We believe this book is the missing link for anyone coming out of school and interested in trading to Wall Street professionals looking to run money. The Option Traders Hedge fund is just that - How to manage risk and trade as the hedge fund pro’s to do.

Polo Financial Group

This blog is dedicated to finding edge in the volatility markets around the world www.polofg.com

Monday, July 2, 2012

Sunday, April 22, 2012

Yes, the decoupled argument was right. However, not the way it was planned to play out

Yes, the decoupled argument was right. However, not the way it was planned to play out

Since 2008/2009, the world markets have taken so many twists and turns and heavy arguments have been made on an array of topics. However, the one thing that is very clear, the world has decoupled. However, not what was traditionally being presented by the presenters of the thesis. The US has actually left all the other nations behind, and not vice-versa. As we discuss US Growth, it is clear that is takes US Super growth and the US economy to be firing on all cylinders for the rest of the world to actually get caught in its cross currents. This can come in in two ways, US consumer leverage growth or US government forced growth - i.e war, ZIRP or QE. US Super Growth can only be a result of mixed organic growth resulting from government induced activity plus the consumer actually further leveraging household balance sheets and being comfortable with crash risk on its books.

1. From the peaks

2. In-spite of the European nations breakdown, money printing and future austerity, the EURUSD cross has not budged since the crisis. US Bond/Equities also used to hold hands pre-crisis. They have since broken up.

3. However, global implied volatility levels are not pricing out the same way. Small gaps have opened up in within local Asian term structures, but for the most part, globally volatility is moving together, in spite of the large spot differences. 1 year variance swaps are all around 37% pct tile. This would imply a continuation of range bound and stale markets we are now used to as part of the triple deleveraging - banks, consumer and governments. This again backs up to our core thesis of LOWER LONG TERM VOLATILITY.

4. Among the global vol asset classes, the same story is being played out.

So why is this happening? Clients responded

Has the US free-money only been recycled into US assets by the entire investment universe? But globally all rates are low?

1. The US is the least worst.

2. The US has Warren Buffett and the FED!

3. The rest of the world is smarter and not expressing local growth which has to come from US Super growth and are therefore not thrilled to invest locally until the US situation has more clarity.

4. The US has primarily focused on inward growth, they are simply not creating the jobs or offshore liquidity pumping structures anymore.

5. The last time I checked, Apple was a US based company.

6. The yields globally simply are not high enough to warrant paying for EM risk beta.

7. Globally petrol price subsidization is lower than levels from 2000-2007, impacting growth directly. Sovereigns cannot add this on onto balance sheets anymore, destroying local margins.

8. A China slowdown must happen to reset global commodity prices lower in a lower subsidization world for global growth to spread away from China and into other nations. The world needs a China slowdown, not leadership!

9. The US has not entered any meaningful austerity as the rest of the world must as they cannot simply print. While the US is pampering squatters in foreclosed houses, the rest of the world is seeing true economic and wealth cuts.

Wednesday, April 4, 2012

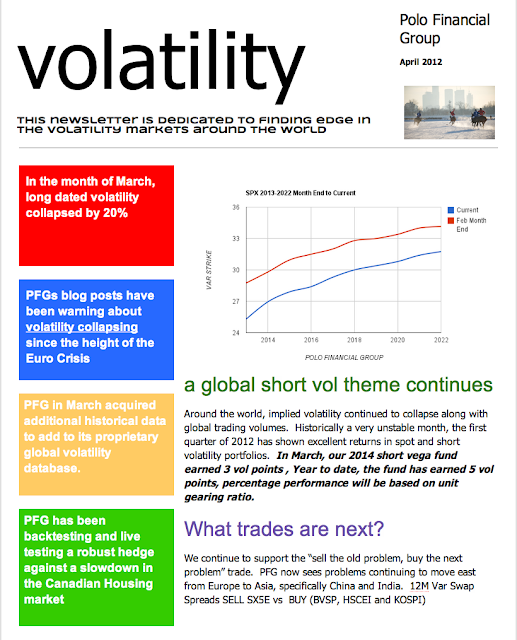

YTD 2014 Short Vega Fund investor letter. Also a look around the world using our Volatility XXX software

YTD 2014 Short Vega investor letter. Also a look around the world using our Volatility XXX software

Monday, March 19, 2012

Self Inflicted perpetual fear: How quickly things can change?

Self Inflicted perpetual fear: How quickly things can change?

80% chance of QE3, now ~ 30%. Interest Rates and Stocks are booming, correlation is rewarding stock pickers with multi year lows when just a few months ago, it was at multi year highs. So what happened, how did we go from headline to headline, 30 handle swings to a parabolic SPX graph that resembles apple?

LTRO, Greece, PSI, EURUSD mentions in MSM have also collapsed. The spotlight is on global growth, free money til 2014. Now rate hikes are priced in 2013? Are we running out of stocks to buy? Financial stocks have in some cases doubled from the lows just set less then 9 months ago. We could go on, but we will come back to our core thesis of de-levering and short long dated vol as what we usually do here at PFG.

Some claim the sunshine is to blame for the optimism or the lack of a winter, others point to the great data coming from the US. Most are skeptical however and looking for the “I knew it” moment when SPX will fall 15 handles and they won’t be short it or have any gamma on. It probably will get bought by the dippers and the story will repeat till 2014. Vol is going to party like it’s 2004. Welcome.

But wait...Irans oil/bomb/war...Election Year, Greece still has..., where are all these new jobs...., Who will buy the MBS paper....I see line ups at open houses again....everything is over-extended for perfection. The fact is that it’s been 4 years since Obama came into the Lehman mess and we are well on our way to finally building a foundation and corporates actually are fine and have cushioned themselves well for a possible attack. Yes, they will still fail, a few might even succeed, but overall the market seems to comfortable with taking risk with a promised low interest till 2014. Ben has given retail its own version of the LTRO, start reading the memo and use it.

1. The power of the FED is clear.

2. Hey wait a minute, why should I fund the ZIRP?

3. What seems as optimism might actually be a “I have no choice to buy stocks and real estate” Mr Black Swan

4. Long dated vols are collapsing

6. But no one is allowed to be short. This is tough one to take to management, we are approaching last years lows fast

7. The NEW NEW thing in Vol, sell the old problem, buy the new problem. This trade will be big in the second half of this year. Sell Euro, Buy Asia vol

8. The challenge the FED faces

Friday, February 24, 2012

Patience: Long Dated Vol will go down, the curve will flatten

Patience: Long Dated Vol will go down, the curve will flatten

In all asset classes, we see the same thing, short dated vols are crushed as the market can’t seem to break out of this low correlation upward drift. It is the max pain path as everyone loaded up on short dated gamma as it “looks cheap”, except all it is doing is getting cheaper and causing option players to re-think continuously what delta they wish to hold against the cheap baby calls they are long. This is no easy matter, the upward drift pnl loss is real, the OTM call option gain is a combination of marks. Gamma and short dated vega is littered all over the street on dealer books. As nothing happens, it is being puked out to avoid paying anymore theta and we should get a move when they finally decide to get short it.

1. Interest Rate Vols

2. Recently steepness has picked up, giving long dated vol sellers a great entry point

3. Forward Vols Implied are also very high

4. Term Structure is also at extremes

Saturday, February 18, 2012

Could we be entering a 2004-2007 low volatility world? All the graphs say yes, but you have to look a little further back in history, otherwise they are all screaming BUY

Could we be entering a 2004-2007 low volatility world? All the graphs say yes, but you have to look a little further back in history, otherwise they are all screaming BUY

While everyone is focused on what will happen with Greece, specifically the March 2011 bond, the risk on world seems to have looked passed the drachma drama. Yes, we may have a few bumps along the way, but money is looking for a much riskier home these days

1. High Yield Spreads have come down really fast

2. Large disconnect between credit and Equity - this is more due to the fed then natural forces to keep cheap money around for a long time

3. Even PIMCO’s Bill Gross has leveraged PIMCO to hold bonds and MBS. A full 180, but also viewed as short vol trade

4. Does anyone care about the Euro Danger? Vol has dropped really fast, skew however has not, currently in about the 85th percentile. Protection via tails is getting expensive again.

5. No demand for term structure for the front months. Record spreads over the last year. So why does no one “need” vol for anything imminent? Is the market simply trying to move vol demand forward and into lower strikes with Euro Bailouts?

6. The risk EM/DM/VIX world also screaming to buy vol? But wait, look to your right and you can see that before all the Euro Drama, the 2004-2007 vol world, post Dot-Com and World Com, the vol markets did nothing for 3 years! and risk on was “ok”

7. Everything is saying buy vol if we just focus on the last 12 months? Is the risk on rally finally sending a message to the vol world that things are going to be fine?

8. According to UBS, global asset class vol viewed in a distribution format shows just have far vols have dropped. So this is not just a VIX story, in fact risk on this YTD is everywhere, except USTs, as the fed is keeping ZIRP 2014 and keeping the back -end kink in check to get people back into the housing trade (twist) - Remember this includes the risk-on in EUROPE, yields have fallen, buyers have shown up to buy bonds and European Banks stocks have boomed.

9. If we widen the horizon, look at post 2003, is post 2011 going to be the same?. Most people are looking at these graphs post 2008 and come up with “vol is cheap”

10. Interest Rate world sending same message - Long dated vol is to high and the story is the same, short dated vol smashed, long term vol has very little supply or courage to push it down.

We continue to believe that long term volatility is very overpriced, probably has a few suppliers and holding term-structure trades are the best way to position for the current environment. No one has any edge over the Euro headlines, as they flip-flop and shake people out of positions. However, we cannot ignore the massive flow into risky assets and markets making large bets that long term vol will go lower. Everyone is waiting for a “whale event” to feel better about selling vol, we are not sure they are going to get it or long vol holders will get the expected outcome.

Thursday, February 16, 2012

Technically Speaking

We typically don't look at charts for our vega book, but this is interesting as we are showing a 2 for 1 payoff at current spot. The market is fully priced for perfection.

With the current boom in spot with a boom in vol, we believe a serious payoff is in store for short vol, short delta. We understand at the recent lows in vol, the marginal buyer will set the price as supply will simply vanish. However, it seems both cash and vol have over-extended.

With the current boom in spot with a boom in vol, we believe a serious payoff is in store for short vol, short delta. We understand at the recent lows in vol, the marginal buyer will set the price as supply will simply vanish. However, it seems both cash and vol have over-extended.

Subscribe to:

Posts (Atom)

.png)