Obituary: Nov 30 2011, The Euro Died.

As we posted yesterday, all risk-off indicators were at extremes and we got almost a 50 point rally in single day! Globally, everyone who had bet on the Euro to cease to exist won, it died. However, the trade was never to buy tails, cds or vix, it was simply to be long USD revenue balance sheets - i.e US Stocks. Why? As we saw today, trades betting a Euro diaster around the world woke up and vaporized quickly. The reason this happened is simple, the whole Earth just put on a massive short USD$ trade. You read that correct, the world is not flooded with dollars, however short USD as they are borrowing today with a promise to pay sometime in the future.

In accounting terms

-FED TRILLIONS USD

+ECB TRILLIONS USD

That leaves the future with every country who has been tapping these swap lines, short even more USD. When the time comes to pay, they will have to print their shit currency and buy ever expensive USD to return to the Fed. This move of course is exactly what the FED wants. They own the printing press which is the only way to cover your short.

So why US Balance Sheets?

The only way to have exposure/short cover a USD$ position is to own USD$ or own an asset that generates USD$. The Fed now has even more ability to print USD$ and they have created future demand for it. Global Balance sheets - ex USD simply cannot do that. They generate in local FX and borrow in USD. This is exactly why in a crisis, the world runs to USD$ as Global balance sheets debt side explodes with shrinking non dollar revenue.

How will this play out?

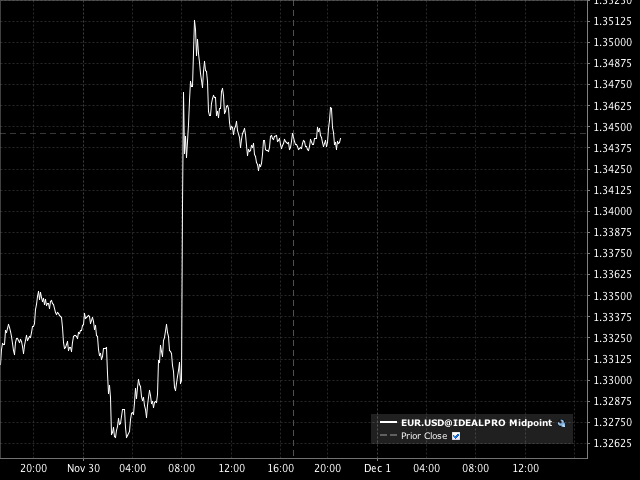

Well the death chart of the EUR after the announcement in fact looks exactly like a heart monitor of an ER patient shot in chest, one final gasp and then flat line.

Obituary: Nov 30 2011, The Euro Died.

As we posted yesterday, all risk-off indicators were at extremes and we got almost a 50 point rally in single day! Globally, everyone who had bet on the Euro to cease to exist won, it died. However, the trade was never to buy tails, cds or vix, it was simply to be long USD revenue balance sheets - i.e US Stocks. Why? As we saw today, trades betting a Euro diaster around the world woke up and vaporized quickly. The reason this happened is simple, the whole Earth just put on a massive short USD$ trade. You read that correct, the world is not flooded with dollars, however short USD as they are borrowing today with a promise to pay sometime in the future.

In accounting terms

-FED TRILLIONS USD

+ECB TRILLIONS USD

That leaves the future with every country who has been tapping these swap lines, short even more USD. When the time comes to pay, they will have to print their shit currency and buy ever expensive USD to return to the Fed. This move of course is exactly what the FED wants. They own the printing press which is the only way to cover your short.

So why US Balance Sheets?

The only way to have exposure/short cover a USD$ position is to own USD$ or own an asset that generates USD$. The Fed now has even more ability to print USD$ and they have created future demand for it. Global Balance sheets - ex USD simply cannot do that. They generate in local FX and borrow in USD. This is exactly why in a crisis, the world runs to USD$ as Global balance sheets debt side explodes with shrinking non dollar revenue.

How will this play out?

Well the death chart of the EUR after the announcement in fact looks exactly like a heart monitor of an ER patient shot in chest, one final gasp and then flat line.

Yes, we will have wild bond prints and wacky headlines, but the EUR IS DEAD.and betting on the Euro Zone implosion makes no sense as they have ample piles of unlimited USD available to fight whatever battle and don’t have to hide in the shame of IMF.

As we mentioned in our white paper early this year. Commodity prices are well bid and the problems will slowly begin to move to China now and why they suddenly needed to adjust the reserve ratio’s after 3 years? Expect demand for USD$ revenue assets to continue and more reports from Muddy Waters. Chanos on China will be the Paulson of Sub-Prime in 12 months. Not going to be a smooth ride.

Yes, we will have wild bond prints and wacky headlines, but the EUR IS DEAD.and betting on the Euro Zone implosion makes no sense as they have ample piles of unlimited USD available to fight whatever battle and don’t have to hide in the shame of IMF.

As we mentioned in our white paper early this year. Commodity prices are well bid and the problems will slowly begin to move to China now and why they suddenly needed to adjust the reserve ratio’s after 3 years? Expect demand for USD$ revenue assets to continue and more reports from Muddy Waters. Chanos on China will be the Paulson of Sub-Prime in 12 months. Not going to be a smooth ride.

December will not be a snoozer - Risk off indicators at extreme, except spot to move 100 points from a re-test

The last time PFG’s key market indicators were at these levels, the market was at 1080 and we had a major lift off. VIX went from 45 to 25 and we rallied 200 points. Now we are at midpoint of the latest extremes -1180 and VIX at 30. PFG believes this market is priced rich and vol will go higher for re-test of 1150 or lower before a rally can happen. The macro situation has gone parabolic and is much worse since the October rally, so we have to ask why are we 100 points higher while our risk off indicators are approaching extremes?

Could we sell off to 1150 with Dec VIX @ 35 and then a rally to 1250 leaving VIX@ 30 to finally finish at 1200 with VIX 32.5? Our indicators show this is very possible. One thing is for sure, we are not going to snooze in Dec.

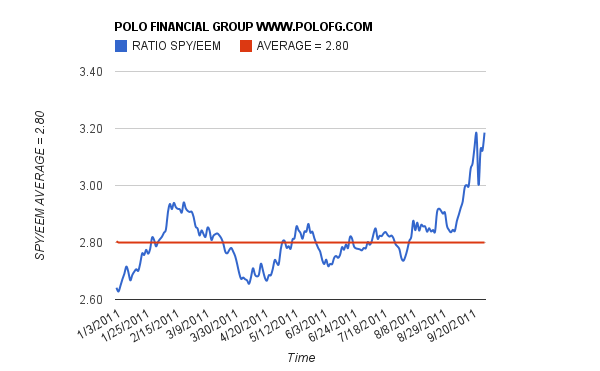

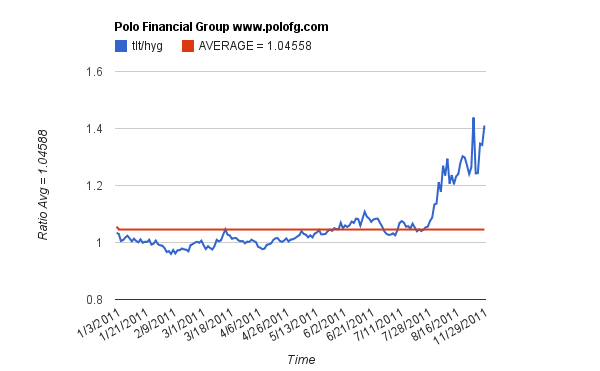

1. Risk Off indicator back at Oct Lows- we started a one month 200 point rally

December will not be a snoozer - Risk off indicators at extreme, except spot to move 100 points from a re-test

The last time PFG’s key market indicators were at these levels, the market was at 1080 and we had a major lift off. VIX went from 45 to 25 and we rallied 200 points. Now we are at midpoint of the latest extremes -1180 and VIX at 30. PFG believes this market is priced rich and vol will go higher for re-test of 1150 or lower before a rally can happen. The macro situation has gone parabolic and is much worse since the October rally, so we have to ask why are we 100 points higher while our risk off indicators are approaching extremes?

Could we sell off to 1150 with Dec VIX @ 35 and then a rally to 1250 leaving VIX@ 30 to finally finish at 1200 with VIX 32.5? Our indicators show this is very possible. One thing is for sure, we are not going to snooze in Dec.

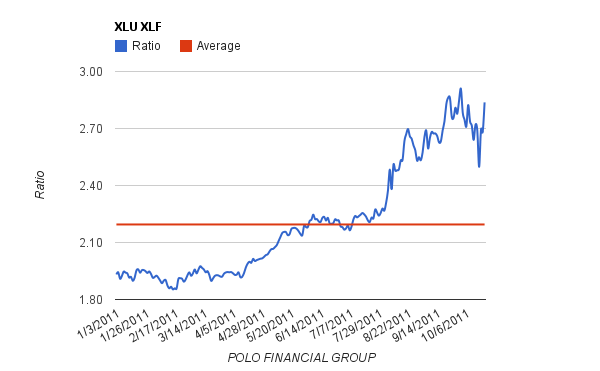

1. Risk Off indicator back at Oct Lows- we started a one month 200 point rally 2. Financials showing again up at oversold levels, however they have room to go down before we see a rally. It will take them to move the index higher.

2. Financials showing again up at oversold levels, however they have room to go down before we see a rally. It will take them to move the index higher. 3. CDS spreads have stayed constant, people have been dumping bonds (de-leverging, spreads wider vs UST) - will that money find it’s way into the stock market? or are we going to see a more selling off in risky bonds? We could compare just Italian Yields with corporates to see that this market is broken.

3. CDS spreads have stayed constant, people have been dumping bonds (de-leverging, spreads wider vs UST) - will that money find it’s way into the stock market? or are we going to see a more selling off in risky bonds? We could compare just Italian Yields with corporates to see that this market is broken.

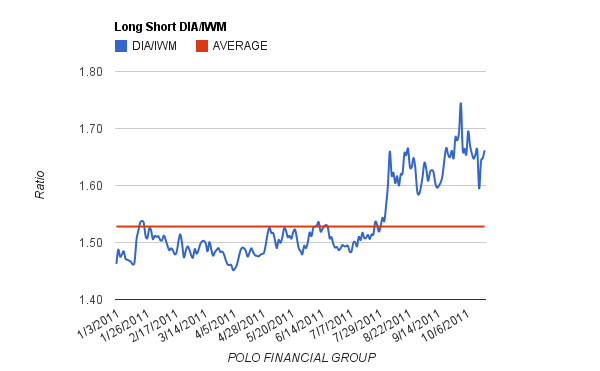

4. Long/Short - same story, high correlation, however - again pointing to levels where the Oct rally started, but no edge either way

4. Long/Short - same story, high correlation, however - again pointing to levels where the Oct rally started, but no edge either way

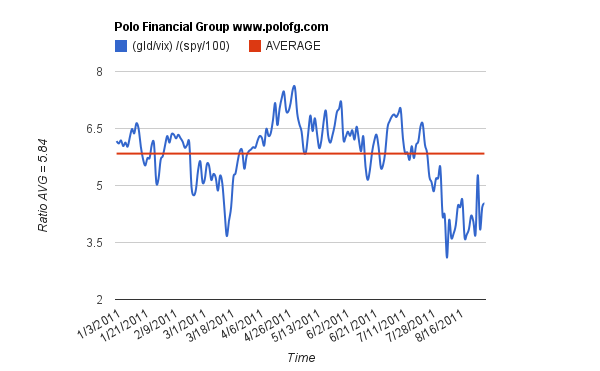

5. Vol using GLD and SPY seems rich and a rally could take VIX to 25 very very fast if a rally starts, however it is already cheap to current spot and we don’t expect this outcome.

5. Vol using GLD and SPY seems rich and a rally could take VIX to 25 very very fast if a rally starts, however it is already cheap to current spot and we don’t expect this outcome.

6. VIX went from 45 to 25, currently we are 30.65 vs 1200 Spot, 1180 Midpoint of rally, 35 midpoint of vix, which if adjust for extremes by 5, we get 30 ish - so vol is fairish to a little cheap. Could a rally keep it sticky?

6. VIX went from 45 to 25, currently we are 30.65 vs 1200 Spot, 1180 Midpoint of rally, 35 midpoint of vix, which if adjust for extremes by 5, we get 30 ish - so vol is fairish to a little cheap. Could a rally keep it sticky?

Reviewing 2012 and beyond trades - vol markets already moving problems into the far future

The last few vol moves show an interesting jump in the back end. Have a look at the 3m,6m, 9m 12m data points with the recent market sell off vs 1M. We see the curve slope change (steepen). However, we also see the concerns pushed forward (back end vol very high)

Reviewing 2012 and beyond trades - vol markets already moving problems into the far future

The last few vol moves show an interesting jump in the back end. Have a look at the 3m,6m, 9m 12m data points with the recent market sell off vs 1M. We see the curve slope change (steepen). However, we also see the concerns pushed forward (back end vol very high)

The market is pricing back-end vol very high and we believe the best trades to take advantage of this is to trade the SPY March 30 120/110/100 Put fly and SPY Dec 2013 125/100 1*2 put spread. If the market rallies, you will get paid well on the 2013 trade and a short term down move in the first quarter of the year, you can take in a possible 10X payoff

Both trades links are here.

SPY March 30 2012

SPY Dec 2013

The market is pricing back-end vol very high and we believe the best trades to take advantage of this is to trade the SPY March 30 120/110/100 Put fly and SPY Dec 2013 125/100 1*2 put spread. If the market rallies, you will get paid well on the 2013 trade and a short term down move in the first quarter of the year, you can take in a possible 10X payoff

Both trades links are here.

SPY March 30 2012

SPY Dec 2013

That thirties show. Trade the VIX 32.50 IRON CONDOR

In a recent post, we pointed out that our market range expectation for year end is 1175/1225 Now that we have challenged this zone, we have a reference point for a VIX level coming from 1275 level into this zone. For path dependent options, it’s very important to understand how the vix behaves in a downward market. Interestingly enough, the market is still selling off on the bad news tape, however the 2% moves are totally acceptable to the VIX and it see’s no reason to gap up violently. In addition, this is in the face of funding stress in Europe, spreads blowing out on bonds, etc. So with the market digesting all this information over a Turkey/Black Friday/US Debt Debates/Christmas Season - we believe the VIX will simply do nothing from here and kiss 32.50 ish. From a supply/demand point of view, we don’t imagine any desk shorting this into year-end (forcing no future squeeze) and no desk getting long at these levels as we get into snooze territory. This can clearly be seen as the market dropped over 5% and the VIX barely budged ( a perfect short delta, short vol trade)

That thirties show. Trade the VIX 32.50 IRON CONDOR

In a recent post, we pointed out that our market range expectation for year end is 1175/1225 Now that we have challenged this zone, we have a reference point for a VIX level coming from 1275 level into this zone. For path dependent options, it’s very important to understand how the vix behaves in a downward market. Interestingly enough, the market is still selling off on the bad news tape, however the 2% moves are totally acceptable to the VIX and it see’s no reason to gap up violently. In addition, this is in the face of funding stress in Europe, spreads blowing out on bonds, etc. So with the market digesting all this information over a Turkey/Black Friday/US Debt Debates/Christmas Season - we believe the VIX will simply do nothing from here and kiss 32.50 ish. From a supply/demand point of view, we don’t imagine any desk shorting this into year-end (forcing no future squeeze) and no desk getting long at these levels as we get into snooze territory. This can clearly be seen as the market dropped over 5% and the VIX barely budged ( a perfect short delta, short vol trade)

To express this view, we are trading the following Iron Condor on the VIX

PFG TRADES THE VIX DEC 27.5/32.5/37.5 FOR A $4 CREDIT

To express this view, we are trading the following Iron Condor on the VIX

PFG TRADES THE VIX DEC 27.5/32.5/37.5 FOR A $4 CREDIT

We believe the risk reward is excellent for this trade - take in a 4$ credit for a maximum 1$ loss (5$ range). - Break Evens set 28.5/36.5

We believe the risk reward is excellent for this trade - take in a 4$ credit for a maximum 1$ loss (5$ range). - Break Evens set 28.5/36.5

Why the volatility curve passes on recent optimism. PFG speaks to the longs.

The recent market optimism surrounding the departure of PM’s around Europe should hardly be any reason to celebrate. Recall that many CEO’s parachuted out (ML, Countrywide, etc before the storm) Nothing is fixed, no debt absolved. As we mentioned before, vol of vol continues to be unprecedented and it’s shadow will show up in the real economy. Last week was no exception.

1 .Last week, we closed at the purple line, vol didn’t hit a new low as the market printed fresh highs for the week

Why the volatility curve passes on recent optimism. PFG speaks to the longs.

The recent market optimism surrounding the departure of PM’s around Europe should hardly be any reason to celebrate. Recall that many CEO’s parachuted out (ML, Countrywide, etc before the storm) Nothing is fixed, no debt absolved. As we mentioned before, vol of vol continues to be unprecedented and it’s shadow will show up in the real economy. Last week was no exception.

1 .Last week, we closed at the purple line, vol didn’t hit a new low as the market printed fresh highs for the week So who is excited about the spot cash markets in SPX and EUR? Recent Survey

1. Long clients are not being “forced to sell” they are starting to believe this “The market has absorbed plenty of negative news, why would I sell?”

2. Long clients have stayed underweight - “Buying the dips has always worked, so why stop now?” Yes, but you are averaging up.

3. When asked why are you ignoring the daily facts - Funding stress, lack of consistency from Europe, etc? De-coupling arguments hit you fast and furious! Basically we have started to believe a Europe implosion, ring fenced or not is not going to impact SPX

4. Year End Rally, Window Dressing, Santa Claus Rally, etc - Hero’s don’t win in financial management.

Well, the vol market is not buying it, preciously because there is no edge in any of these arguments. To actually see a formulated thesis that can capture the whole Europe situation, from the long or short side, is simply horseshit. The timeline is firstly impossible and a headline driven market will not give you a chance to go back to the drawing board. You will be immediately offside and be pressed to make a move. No need to bore anyone with just how high spreads are in Europe to baseline Bunds. But these are actually real facts, painful and very telling of how quickly trillions of debt can get re-valued, forcing capital raises, funding stress, etc. Remember, the bond markets dwarf the equity markets many many times over. Yes, it’s not easy to say how or when the market could crack, but the path undoubtedly has been paved that gets worse everyday the problems are pushed into the future.

So who is excited about the spot cash markets in SPX and EUR? Recent Survey

1. Long clients are not being “forced to sell” they are starting to believe this “The market has absorbed plenty of negative news, why would I sell?”

2. Long clients have stayed underweight - “Buying the dips has always worked, so why stop now?” Yes, but you are averaging up.

3. When asked why are you ignoring the daily facts - Funding stress, lack of consistency from Europe, etc? De-coupling arguments hit you fast and furious! Basically we have started to believe a Europe implosion, ring fenced or not is not going to impact SPX

4. Year End Rally, Window Dressing, Santa Claus Rally, etc - Hero’s don’t win in financial management.

Well, the vol market is not buying it, preciously because there is no edge in any of these arguments. To actually see a formulated thesis that can capture the whole Europe situation, from the long or short side, is simply horseshit. The timeline is firstly impossible and a headline driven market will not give you a chance to go back to the drawing board. You will be immediately offside and be pressed to make a move. No need to bore anyone with just how high spreads are in Europe to baseline Bunds. But these are actually real facts, painful and very telling of how quickly trillions of debt can get re-valued, forcing capital raises, funding stress, etc. Remember, the bond markets dwarf the equity markets many many times over. Yes, it’s not easy to say how or when the market could crack, but the path undoubtedly has been paved that gets worse everyday the problems are pushed into the future.

Set it and Forget it - Sell Skew, receive a credit and protection for 2 years! - Market Next Steps.

Set it and Forget it - Sell Skew, receive a credit and protection for 2 years! - Market Next Steps.

Recently upon watching the market ping-pong around our 1250 market fair value, we started laying out very cheap portfolio protection trades. Another trade which forces you to buy the market at 732 in 2 years from today is the SPY Dec 20 2013 125/100 1 by 2 put spread.

We recently started to build a position in this trade as we feel that our 732 break even is an acceptable risk and the skew is rich. If the market rips, you keep your credit.

PFG believes in the next following steps for the market

1. Lack of positioning into year end will take the market closer to 1175 - our range is 1175/1225 year end.

If the market makes a leg down, we don’t imagine sell side desks are going to stand up and be committing capital at these high levels in the market, thus pushing more orders into algos, taking the market lower in a grinding fashion ending with a high volume gap down.

2. Longs are nervous and are also baffled with the markets performance - however avg buy in is lower, so no need to hit eject.

“If you are the first one out, you are not panicking.”

3. 2012/2013 will see lower spot and lower vol - a painful double dip, PFG prefers to call it an “Economic restructuring”

As we pointed out in our early September white paper on the de-levering consumer, commodity raw inputs are simply not available on the cheap. With oil pushing to 100$, we cannot see how a already stretched pocket book can continue to spend. Everything must slow down, deflation will be forced via low economic participation.

4. High Oil prices will bring us out of the “economic restructuring”

With the fed the continuing to feed excess capacity, we still have 10 suppliers where the efficient market says 4. High Oil prices will squeeze the weak hands out of business as they cannot pass it on, the market will toss out the excess capacity as we reset to this normal.

5. Japan playbook is still ruling bond markets

I took an interesting look at prices from 1915 to today - what is our current long bond rate? You won’t even be able to watch a movie, get a hot dog or grab a beer

Are you spending? Why clarity will come in 2012

Are you spending? Why clarity will come in 2012

The current vol of vol in the market is simply unprecedented. Investors, corporations are simply dumbstruck at how to proceed. The simple answer was if looking back on 2011, was do nothing. 2012 will force a hand, a real Euro resolution, plan for spending, growth, jobs, elections and US Debt control. The bullish case at this point is “everyone is too bearish” and the market continues to get very oversold and structurally so bad offside, that we have large rallies timed perfectly with bad news! Can this continue? PFG believes once the smoke and mirrors and year-end is done, no one will have a clue on how to position into 2012, conservatism will be the overall guiding factor for investing.

Current market is 1250, we see that as a fair, you are not getting this market for cheap anymore, if you missed the October rally, to bad. We estimate 100$ in earnings, 12.5X = 1250 Index. With consumers savings and de-levering, we estimate that 2012 will not only see weak growth, but also it will be front loaded into the first quarter.

Have a look at the vol of vol just in the past week below. One thing that stands out is the hump about at 6months from now. We believe that the current market volatility will be seen in the real economy around that time. Spending will be down this year end and banks on their backs. It will show up early in 2012.

The best way we feel to set up for this is to sell expensive market skew and be patient. This trade is also a great portfolio protection trade, so we also anticipate demand to favor our trade to a some small degree.

PFG buys SPY March 30 2012 120/110/100 put butterfly @ 1$ for 10X max payoff

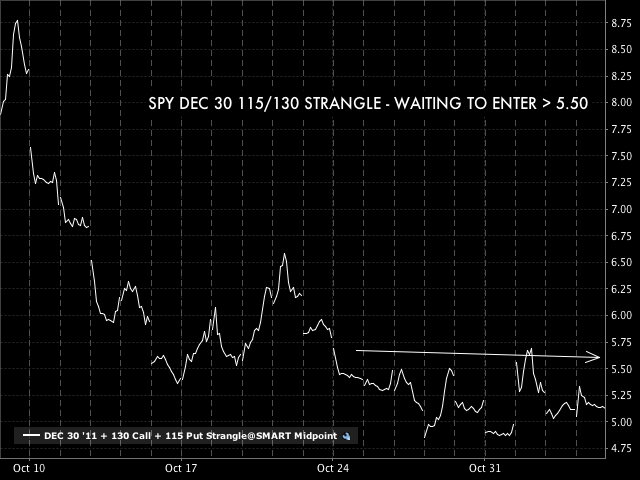

In connection with this trade, we believe the market will stay in between 1175 and 1225 into year-end. So will look to sell the SPY Dec 30 2011 115/130 Strangle to stay conservative and collect premium into year end.