Yes, the decoupled argument was right. However, not the way it was planned to play out

Since 2008/2009, the world markets have taken so many twists and turns and heavy arguments have been made on an array of topics. However, the one thing that is very clear, the world has decoupled. However, not what was traditionally being presented by the presenters of the thesis. The US has actually left all the other nations behind, and not vice-versa. As we discuss US Growth, it is clear that is takes US Super growth and the US economy to be firing on all cylinders for the rest of the world to actually get caught in its cross currents. This can come in in two ways, US consumer leverage growth or US government forced growth - i.e war, ZIRP or QE. US Super Growth can only be a result of mixed organic growth resulting from government induced activity plus the consumer actually further leveraging household balance sheets and being comfortable with crash risk on its books.

1. From the peaks

2. In-spite of the European nations breakdown, money printing and future austerity, the EURUSD cross has not budged since the crisis. US Bond/Equities also used to hold hands pre-crisis. They have since broken up.

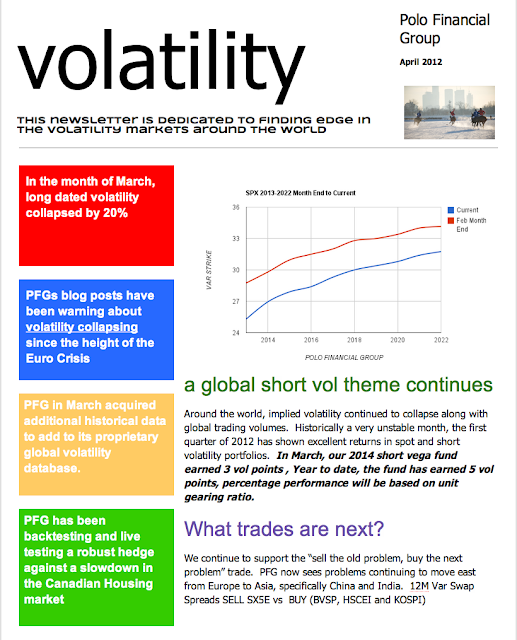

3. However, global implied volatility levels are not pricing out the same way. Small gaps have opened up in within local Asian term structures, but for the most part, globally volatility is moving together, in spite of the large spot differences. 1 year variance swaps are all around 37% pct tile. This would imply a continuation of range bound and stale markets we are now used to as part of the triple deleveraging - banks, consumer and governments. This again backs up to our core thesis of LOWER LONG TERM VOLATILITY.

4. Among the global vol asset classes, the same story is being played out.

So why is this happening? Clients responded

Has the US free-money only been recycled into US assets by the entire investment universe? But globally all rates are low?

1. The US is the least worst.

2. The US has Warren Buffett and the FED!

3. The rest of the world is smarter and not expressing local growth which has to come from US Super growth and are therefore not thrilled to invest locally until the US situation has more clarity.

4. The US has primarily focused on inward growth, they are simply not creating the jobs or offshore liquidity pumping structures anymore.

5. The last time I checked, Apple was a US based company.

6. The yields globally simply are not high enough to warrant paying for EM risk beta.

7. Globally petrol price subsidization is lower than levels from 2000-2007, impacting growth directly. Sovereigns cannot add this on onto balance sheets anymore, destroying local margins.

8. A China slowdown must happen to reset global commodity prices lower in a lower subsidization world for global growth to spread away from China and into other nations. The world needs a China slowdown, not leadership!

9. The US has not entered any meaningful austerity as the rest of the world must as they cannot simply print. While the US is pampering squatters in foreclosed houses, the rest of the world is seeing true economic and wealth cuts.

.png)