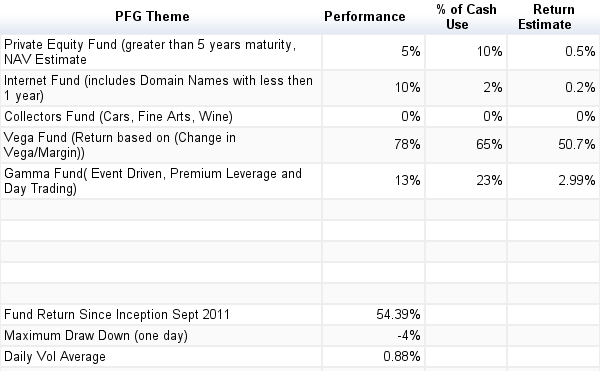

PFG Year End Performance

Implied Vol 14.08%

Watermark Leverage 16.8

Average Leverage 4

PFG Year-End Management note

We are still very early in performance meaning anything to actually project, since September however we have learned a few valuable lessons.

2012 Themes

1. We continue to see value in Web Security Stocks and out of favor names

Performance

Web Basket + 11%

Out of Favor -13.5%

2. Hold financial upside calls for an Obama failure

3. Systematic Algo VIX Iron Condor Trading - Cheap Tail Hedge for a short vol portfolio

4. Enter into short vol trades on market fear

Implied Vol 14.08%

Watermark Leverage 16.8

Average Leverage 4

PFG Year-End Management note

We are still very early in performance meaning anything to actually project, since September however we have learned a few valuable lessons.

- Day Trading is very stressful and best left to machines/systematic emotionless folks

- Taking money off the table, entering trades should be done in thirds, no more, no less

- Risk management, over analysis of positions does payoff at the end in profit maximization.

- Staying focused on your thesis, challenging your book everyday when offside by flipping it around and asking “what am i rooting for?” Don’t ask yourself why your positions are losing, rather why the opposite book to yours is winning

- No way to remove emotions of trading unless you can allow a computer to trade your money and walk away.

2012 Themes

1. We continue to see value in Web Security Stocks and out of favor names

Performance

Web Basket + 11%

Out of Favor -13.5%

2. Hold financial upside calls for an Obama failure

3. Systematic Algo VIX Iron Condor Trading - Cheap Tail Hedge for a short vol portfolio

4. Enter into short vol trades on market fear

No comments:

Post a Comment